On June 15, the Federal Reserve increased their benchmark interest rate by 75 basis points. It was the largest interest rate increase since 1994. As of June 9, the Freddie Mac 30 year mortgage rate was at 5.23%. This rise in the Federal funds rate is sure to increase mortgage rates even higher. In the real estate world, there are those who are beginning to panic. An interest rate increase of such magnitude is sure to slow demand. And well, that’s kind of the point.

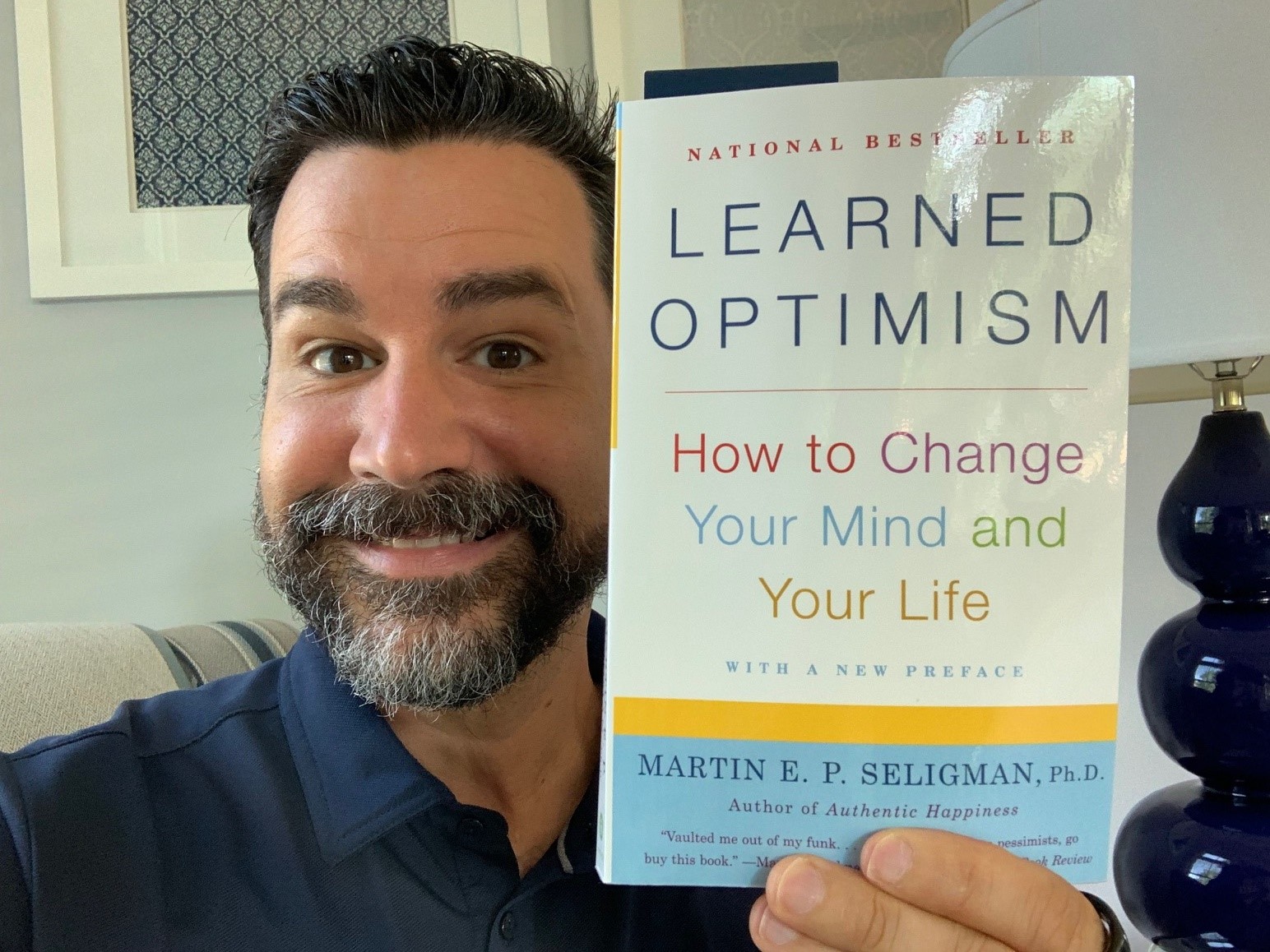

Let me digress for a moment. W Realty Group is a team of professionals committed to being the best that we can be. Internally, we have our own sort of book club and as a team we are currently reading Learned Optimism by Martin Seligman. At its most basic, the book shows through a tremendous about of scientific experiments that optimistic people are happier than pessimists. We all know who the optimists and the pessimists are in our lives. What’s your own leaning? We learn to become pessimists and we can also learn to be optimistic. Plain and simple, it all boils down to your most fundamental beliefs.

Back to the real estate market. In 2009-2013, the issue at hand in real estate was an oversupply of houses. Buyers were incredibly picky and took their sweet time because they had so much to choose from. The tables have turned and the issue over the past few years has been that there is not enough inventory and buyers are having to compete over this limited supply.

Rising interest rates means demand will slow, homes will stay on market a bit longer and inventory will increase. That means a return to buyers having more choices again. So are rising interest rates a good thing or a bad thing? Maybe it depends on whether you are an optimist or a pessimist. And if you don’t know, maybe you should consider whether the creators of the content you are taking in are optimists or pessimists. Remember, science has proven that optimists are happier.

By the way……we love this stuff. If you’ve read Learned Optimism and want to participate in the conversation, send any of us an email. We’d love to discuss!

In the meantime, here is a summary of the latest market stats comparing single family home sales in Mecklenburg County for May to the prior month and the same period last year:

- Home sales are up 5% from last month, but down 10% from last year.

- Average sales price is up 1% from last month and 15% from last year.

- Median sales price is up 3% from last month and 23% from last year.

- Current sale to list price ratio is 104%

- Average time on market is down 35% from last month and 25% from last year.

- Pending sales are down 1% from last month and 12% from last year.

- Housing supply is up 59% from last month and 86% from last year.

- Mortgage rates at 5.23% are up 25 points from last month and up from 2.96% last year.

- Average house payment is up 4% from last month and 50% from last year.