Lots of mixed messages about real estate and the real estate market this year. Let’s be sure not to confuse the two. There’s been a lot of turmoil in the market this year with low inventory, rising prices, and high interest rates. These factors have made it more challenging for owners that want to sell to list their home for fear of losing a great interest rate. It’s been even harder on buyers who want to get into the market but are challenged by the double whammy of higher prices and interest rates, which translates to a bigger than expected mortgage payment. Because of all of this, there have been fewer sales to go around making it tough for those who make a living in the industry to make ends meet.

All of the above is temporary and as the cliche goes, this too shall pass. The fundamentals of real estate as an investment have not changed and right now those who own real estate are sitting pretty. As I reflect on the challenges and also the rewards of a year full of both, I am so grateful for my younger self,(along with Maria’s), for choosing to invest in real estate. Ownership in 2023 has given me peace of mind and confidence in a strong foundation. As real estate prices continue to climb, I’ve personally witnessed hundreds of past clients with increased financial net worth thanks to the simple fact that they chose to buy a home. This is not something that changes with the wind or volatile interest rates. Buying and holding real estate for the long term is simply the best way to build wealth.

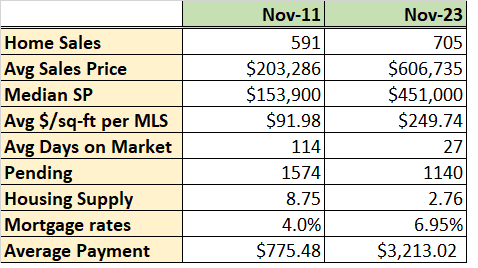

This being my last blog post of 2023, I’d like to reflect back in time. The number of single-family home sales in Mecklenburg County this past November was the lowest in any November since 2011. 2011 was the bottom of the Charlotte real estate market during the Great Recession. Can we compare today’s market to that one twelve years ago? Let’s take a look at some data:

It’s hard to believe that both the average and median sales prices have risen almost 300% since then. This represents an average annual return of approximately 10% per year since then. Aside from much lower prices, we see that back then it was a buyers’ market (more than 6 months supply) and homes were taking a lot longer to sell. The higher interest rates of today are helping to balance out the lower time on market and low supply that we’ve been experiencing for many years now. Hopefully this results in more choice for buyers next year.

If you bought a home in 2011, you are most certainly thanking your lucky stars as your home has likely been the greatest contributor to your long-term financial growth. I’m willing to bet that when I post a similar chart to this one in another 12 years, those who bought real estate in 2024 will also be grateful that they did. Are you ready to grow your wealth next year?

Happy holidays and a very happy New Year to all! See you in 2024. Oh and as always, if you’d like to see the most recent market stats for Single Family Home Sales in Mecklenburg County in November, you can check them out here.